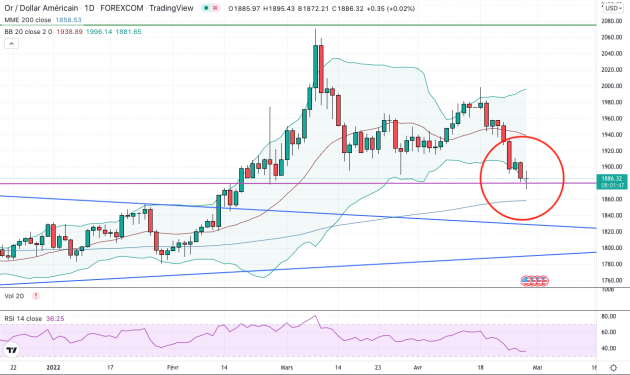

Focus on gold in dollars

On a daily basis, gold in USD is testing a support zone around $1880.

Source: Tradingview

It has lost about -5.6% since its April 18 high.

It could fall a bit further to test the MM200 around $1860.

On a weekly basis (below), gold is testing another important support level: the average of the Bollinger Bands.

Source: Tradingview

Will it find a bottom in its digestion of the March 2022 rally? Probably, but it could very well come in and retest the upper line of the consolidation triangle (in blue) if the dollar continues to strengthen.

So, for now, we remain very attentive to the various support zones to see if gold closes the week, and the month, below $1880.

On a monthly basis, the yellow metal continues to evolve as we indicated in the March 10, 2022 analysis: consolidation after a significant rise or formation of a cup and handle pattern.

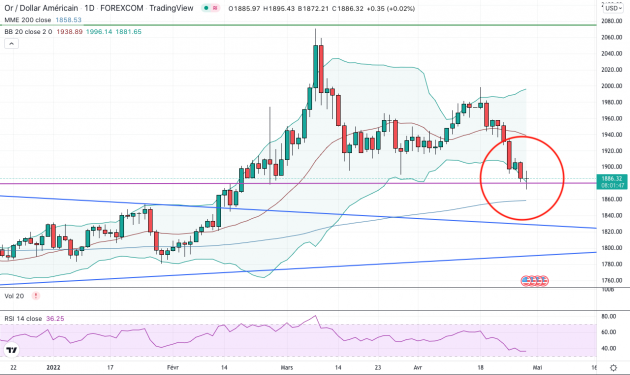

The euro plunges against the dollar

Beware: the current strength of the dollar is naturally reflected in the prices of the yellow metal in the various currencies.

Source: Tradingview

The U.S. dollar index (DXY) hit a high on expectations of a Fed rate hike.

On the other hand, the euro weakened after Russia cut off gas supplies to Bulgaria and Poland, which refused to pay in rubles.

For the month, the dollar gained +5.4% against the euro.

As a result, the price of gold is currently -2.6% in dollars, but +2.6% in euros.

The US dollar is breaking a long-term triangle, which increases the likelihood of a return to parity if the breakout is confirmed.

Source: Tradingview

Fears of a recession in the EU are intensifying and growth forecasts are being revised downwards in view of the situation with Russia.

This is probably a bullish signal for the gold price in euros. The safe-haven asset will be increasingly in demand.

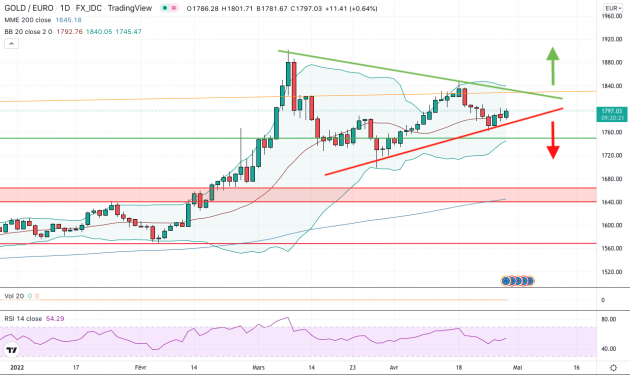

In the shorter term, the yellow metal expressed in euros continues to stabilize. It is tracing a consolidation triangle on a daily basis from its high of March 8, 2022.

Source: Tradingview

Source: Tradingview

Volatility is tightening around the average of the Bollinger bands, the RSI is at 55. It is quietly maturing its exit from the triangle that we could see during the month of May.

Sell in May and Go Away

If investors follow the stock market adage of "Sell in May and Go Away", which consists of selling stocks in May to spend the summer quietly and return to the markets in the fall, this could benefit real assets like gold.

The S&P500 is down -7.6% for the month, its biggest loss since February-March 2020!

The World Gold Council's quarterly report also reveals that demand for gold has increased by +34% compared to Q1 2021, thanks in particular to ETFs, which have seen their largest inflows since Q1 2020 (+269 tonnes).

Indeed, the demand for safe haven is increasing due to global tensions and uncertainty.

So, will the Fed be able to deliver on its promises of rate hikes and monetary policy tightening?

We will see, but it will probably be very complicated. The situation in Europe is also complex due to the lack of visibility.

Gold has every chance to shine in the coming months.

>>> Discover our current promotions

The GFI team

--

Disclaimer:

The data presented on this page is provided for information purposes only and does not constitute investment advice, an offer to sell or a solicitation to buy, and should not be relied upon as a basis for/or inducement to engage in any investment.

Past performance is not constant over time and is not indicative of future performance. This newsletter does not take into account your financial situation and objectives. The investor is the sole judge of the appropriateness of the transactions he/she may enter into.

The information on this website is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

For more information about Gold and Forex International: see the Terms and Conditions.