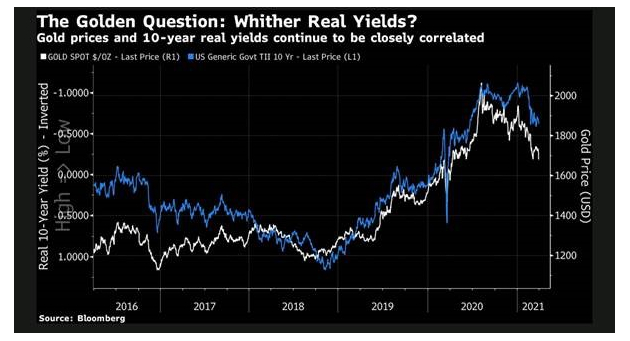

Eurozone inflation rose to 1.3% in March, the highest level since the start of the pandemic. This is still far below the ECB 2% target but the latest evidence inflation is becoming a theme again. Gold is seen by many, including us, as a good inflation hedge and should have increased with inflation. As an investment the golden hedge has not worked out yet as the gold price in USD is down 19% from its high last August and back to pre-pandemic levels.

The main reasons:

Real interest are increasing as nominal yields are rising faster than inflation and

Gold ETF’s became big sellers due to redemptions after significant inflows last year and

Crypto is competing as it is considered the new gold and

The USD.

We believe however the current consensus negativity around gold could prove a golden opportunity for the patient investors.

Take care not to become victim of any 1st of April jokes ( Voltswagen ? ),

Disclaimer:

The data presented on this page is provided for information purposes only and does not constitute investment advice, an offer to sell or a solicitation to buy, and should not be relied upon as a basis for/or inducement to engage in any investment.

Past performance is not constant over time and is not indicative of future performance. This newsletter does not take into account your financial situation and objectives. The investor is the sole judge of the appropriateness of the transactions he/she may enter into.

The information on this website is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

For more information about Gold and Forex International: see the Terms and Conditions.