The yellow metal makes a breakthrough

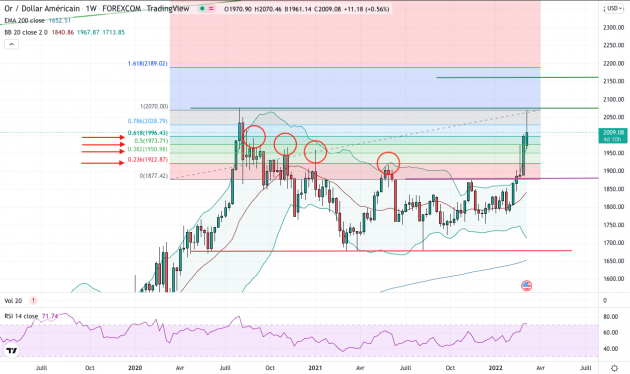

Gold expressed in US dollars has gained +15% in just over a month, from its February low to its March high.

It is currently trading near the psychological barrier of $2,000.

In intraday trading, it is re-testing this resistance which has become a support.

On Monday, March 8, it hit the $2075 area, the previous historical high recorded in August 2020.

Source: Tradingview

The yellow metal has drawn a nice cup and we would like to see it draw a clean handle to indicate a solid trend continuation.

There are a few things that point to a possible momentary lull:

-

An all-time high to work with (with a handle)

-

An RSI at 72 indicating entry into the overbought zone

-

The upper Bollinger band has been exceeded for 4 weeks.

Reminder: Technical analysis does not predict the future, it offers us probabilities. These can be swept away in the event of an increase in geopolitical tensions and an irrational surge.

In terms of targets: the closest would be in the $2150 area if we shift the amplitude of the triangle by about 15% at the breakout.

Then comes the $2300 area if we shift the amplitude of about 10% between the historical high and the pivot (purple line).

For technical analysis enthusiasts, let's look at the Fibonacci retracement for the formation of the handle.

Source: Tradingview

If we retrace to the pivot point around $1875, we see that the intermediate levels are relatively close to the previous levels observed when the cup formed: 1995, 1970, 1950, 1920.

So, if the cup forms, how far will it go? All bets are off.

Grey metal in ambush

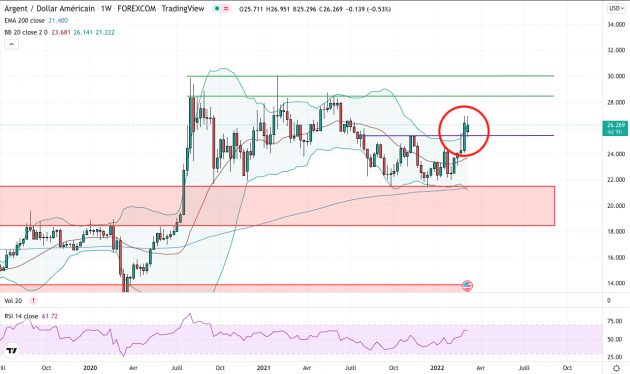

Silver gained +23% between February 3 and March 8 and is currently trading around $26/ounce.

Source: Tradingview

Unlike gold, it is still far from its historical high of $49.7.

But we note that the break of the $25 pivot that started at the end of February is confirmed and silver is re-testing this resistance turned support.

We hope to see the gray metal come to seek the next resistances around $28 and $30 to be able to finally break out of this horizontal consolidation channel started in August 2020.

The odds tell us that it should follow gold's trend with some lag, as usual.

>>> Create an account on our secure platform to be ready to buy, sell and store easily at any time.

See you soon,

The GFI team

PS: Don't want to miss any important information? To know regularly and quickly where gold and silver stand? Subscribe below to our 100% free newsletter.

--

Disclaimer:

The data presented on this page is provided for information purposes only and does not constitute investment advice, an offer to sell or a solicitation to buy, and should not be relied upon as a basis for/or inducement to engage in any investment.

Past performance is not constant over time and is not indicative of future performance. This newsletter does not take into account your financial situation and objectives. The investor is the sole judge of the appropriateness of the transactions he/she may enter into.

The information on this website is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

For more information about Gold and Forex International: see the Terms and Conditions.