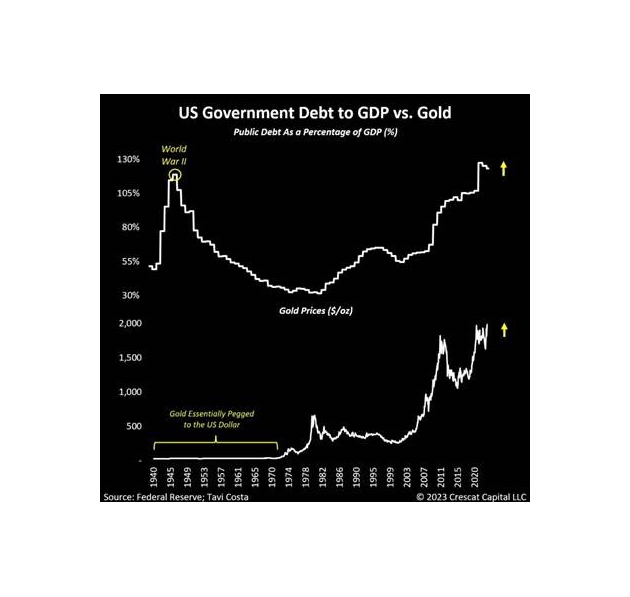

Worried by the discussion about the debt ceiling … own gold. The argument brought forward by several strategist on Wall Street goes as follows: the political drama about the debt ceiling will ultimately result again into more debt as this debt is required to finance an US budget that was voted. Higher debt levels inevitably go together with higher gold prices especially when gold is not pegged to the USD ( since the end of the gold standard in 1971 ). At the same time, the Fed can only rise interest rates to a level where the Fed does not overkill the economy. In the resulting inflationary environment, it appears reasonable to own gold in a diversified portfolio as an inflation hedge despite the fact that gold does not produce cash flows.

At ECP, gold is therefore part of the asset allocation of multi-asset portfolios.

Source: Crescat Capital LLC

Léon